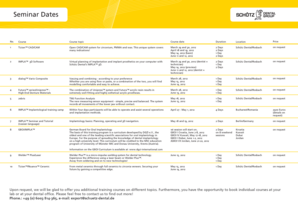

Get the free cms illinois deferred compensation fax form - www2 illinois

Show details

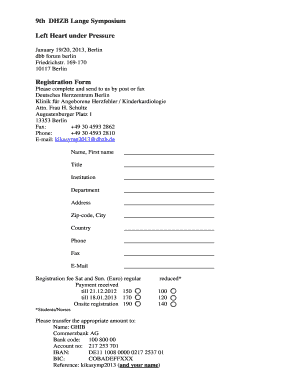

CMS Last Name Street Agency or University Work Address ILLINOIS DEPARTMENT OF CENTRAL MANAGEMENT SERVICES P.O. Box 19208, Springfield, IL 62794-9208 STATE EMPLOYEES' DEFERRED COMPENSATION PLAN ENROLLMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cms illinois deferred compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cms illinois deferred compensation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cms illinois deferred compensation online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cms illinois deferred compensation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out cms illinois deferred compensation

How to fill out CMS Illinois Deferred Compensation:

01

Visit the official website of CMS Illinois Deferred Compensation.

02

Locate the forms section and download the appropriate form for enrollment or contribution changes.

03

Fill out the form with your personal information such as name, address, and social security number.

04

Indicate the amount you wish to contribute to the deferred compensation plan.

05

If applicable, specify any changes to your current contribution percentage or investment allocation.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form.

08

Submit the completed form to the designated address or office as indicated on the form.

Who needs CMS Illinois Deferred Compensation:

01

Employees of the state of Illinois who are eligible for participation in a retirement plan.

02

Individuals looking for a tax-efficient way to save and invest for retirement.

03

Those who want to take advantage of the employer matching contribution provided through the deferred compensation plan.

04

Employees seeking additional retirement savings options beyond their pension or Social Security benefits.

05

Individuals who desire control over their investment choices and the potential for long-term growth.

Note: It is recommended to consult with a financial advisor or tax professional for personalized advice regarding CMS Illinois Deferred Compensation or any other retirement savings plan.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cms illinois deferred compensation?

CMS Illinois Deferred Compensation refers to a retirement savings plan offered to public employees in the state of Illinois. The plan allows employees to contribute a portion of their salary on a pre-tax basis, reducing their taxable income. These contributions are then invested in various investment options, chosen by the employee, to grow over time. The CMS Illinois Deferred Compensation plan is administered by the Illinois Department of Central Management Services (CMS), which is responsible for overseeing the state's human resources and fostering efficient business operations. The plan offers employees a convenient way to save for retirement and benefit from potential tax advantages.

Who is required to file cms illinois deferred compensation?

The CMS (Central Management Services) Illinois Deferred Compensation program is available for eligible state employees and employees of participating local government employers. These employees may choose to participate in the program and make contributions to their deferred compensation accounts. Therefore, the individuals who are required to file CMS Illinois Deferred Compensation plans are those who are employed by the state or participating local government employers and choose to enroll in the program.

How to fill out cms illinois deferred compensation?

To fill out the CMS Illinois Deferred Compensation form, follow these steps:

1. Visit the Illinois State Employees Deferred Compensation Plan website.

2. Download the CMS Illinois Deferred Compensation Enrollment Form.

3. Fill out the personal information section, including your name, address, social security number, date of birth, and contact information.

4. Provide employment information, such as your agency name, department, position, and hire date.

5. Select your investment options by indicating the percentage or dollar amount you want to allocate to each investment option provided.

6. If you wish to designate a beneficiary, fill out the beneficiary section with the required information, such as the name, relationship, and percentage or dollar amount to be distributed.

7. Review the terms and conditions of the plan and sign and date the form.

8. Submit the completed form to the designated address or contact provided by the Illinois Deferred Compensation Plan.

It is advised to double-check the form and ensure that all required fields are completed accurately before submission.

What is the purpose of cms illinois deferred compensation?

The purpose of CMS (Central Management Services) Illinois Deferred Compensation is to provide a voluntary retirement savings plan for employees of the state of Illinois and certain other eligible employers. It allows employees to set aside a portion of their pre-tax income to save for retirement, with contributions made through automatic payroll deductions. The program aims to help participants accumulate savings for retirement and offers various investment options to help grow their funds.

What information must be reported on cms illinois deferred compensation?

On CMS Illinois Deferred Compensation, the following information must be reported:

1. Personal Information: This includes your name, address, social security number, date of birth, and contact information.

2. Contribution Information: All contributions made to the plan, including the amount contributed and the date of contribution, should be reported.

3. Investment Allocation: The plan offers various investment options, and you must report the percentage or dollar amount allocated to each investment option.

4. Investment Changes: Any changes made to the investment allocation, such as switching funds or changing contribution percentages, need to be reported with the date of the change.

5. Beneficiary Designation: You must report the names and contact information of your designated beneficiaries.

6. Loans and Withdrawals: If you have taken any loans or withdrawals from your deferred compensation account, you need to report the details, including the amount, date, and purpose of the loan or withdrawal.

7. Rollovers: Any rollovers into or out of the CMS Illinois Deferred Compensation plan should be reported, including the source of the rollover and the date of the transaction.

It's important to note that the specific reporting requirements can vary, and it's recommended to consult the official documentation or contact the plan administrator for the most accurate and up-to-date information.

What is the penalty for the late filing of cms illinois deferred compensation?

According to the Illinois Department of Revenue, the penalty for the late filing of CMS Illinois Deferred Compensation is 2% per month (or part of a month) up to a maximum of 12%. However, it is always recommended to consult with a tax professional or the Illinois Department of Revenue for specific and up-to-date information regarding penalties and any other tax-related questions.

Can I create an electronic signature for signing my cms illinois deferred compensation in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your cms illinois deferred compensation right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I complete cms illinois deferred compensation on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your cms illinois deferred compensation, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit cms illinois deferred compensation on an Android device?

The pdfFiller app for Android allows you to edit PDF files like cms illinois deferred compensation. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your cms illinois deferred compensation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.